Virtual Gift 'Worcestershire's Wonderful Wetlands'

Stuck for that perfect gift idea? Fed up of wasting paper? This virtual e-gift will make an environmentally responsible, unique and thoughtful present for a loved one and will help us to protect what remains of Worcestershire's wetlands.

We will send a beautiful e-card to your loved one via email, telling them that this gift has helped Worcestershire Wildlife Trust protect wetland habitats across the county. The e-card also can be personalised with your own special message.

Worcestershire’s freshwater wetlands and waterways provide wildlife with ‘corridors’, which they can use to move between fragmented habitats. These varied habitats support a diverse range of plants and animals including everything from fish to damselflies and from otters to birds. However, these important wildlife sites have been in serious decline over the years as waters have been polluted, land drained and riverbank habitats stripped and modified.

With the loss of wetlands have come dramatic reductions in wildlife, including populations of birds such as snipe, curlew and lapwing. In the UK, between 2010 and 2011, lapwing declined by 18%, curlew by 13% and snipe by a staggering 40%! Populations of otter, water vole, great crested newt and redshank have also seen their habitats diminish and disappear.

Gifts like this make it possible for us to protect and maintain our wetland nature reserves and to create and restore new areas for the future.

* Worcestershire Wildlife Trust is entitled to reclaim the tax made on gifts by UK tax payers. This means that if you are a UK tax payer, your donation can increase by 25% - at no extra cost to you. If you choose to gift aid your donation, please remember that you need to have paid an amount of UK Income and/or Capital Gains tax in any tax year at least equal to the amount claimed by all the charities or Community Amateur Sports Clubs you donate to, (currently 25p per £1 donated). If this will not be the case or you cease to be a taxpayer, please let us know. Also, if you pay less income tax and/or capital gains tax in the current year than the amount of Gift Aid claimed on all your donations it is your responsibility to pay any difference.

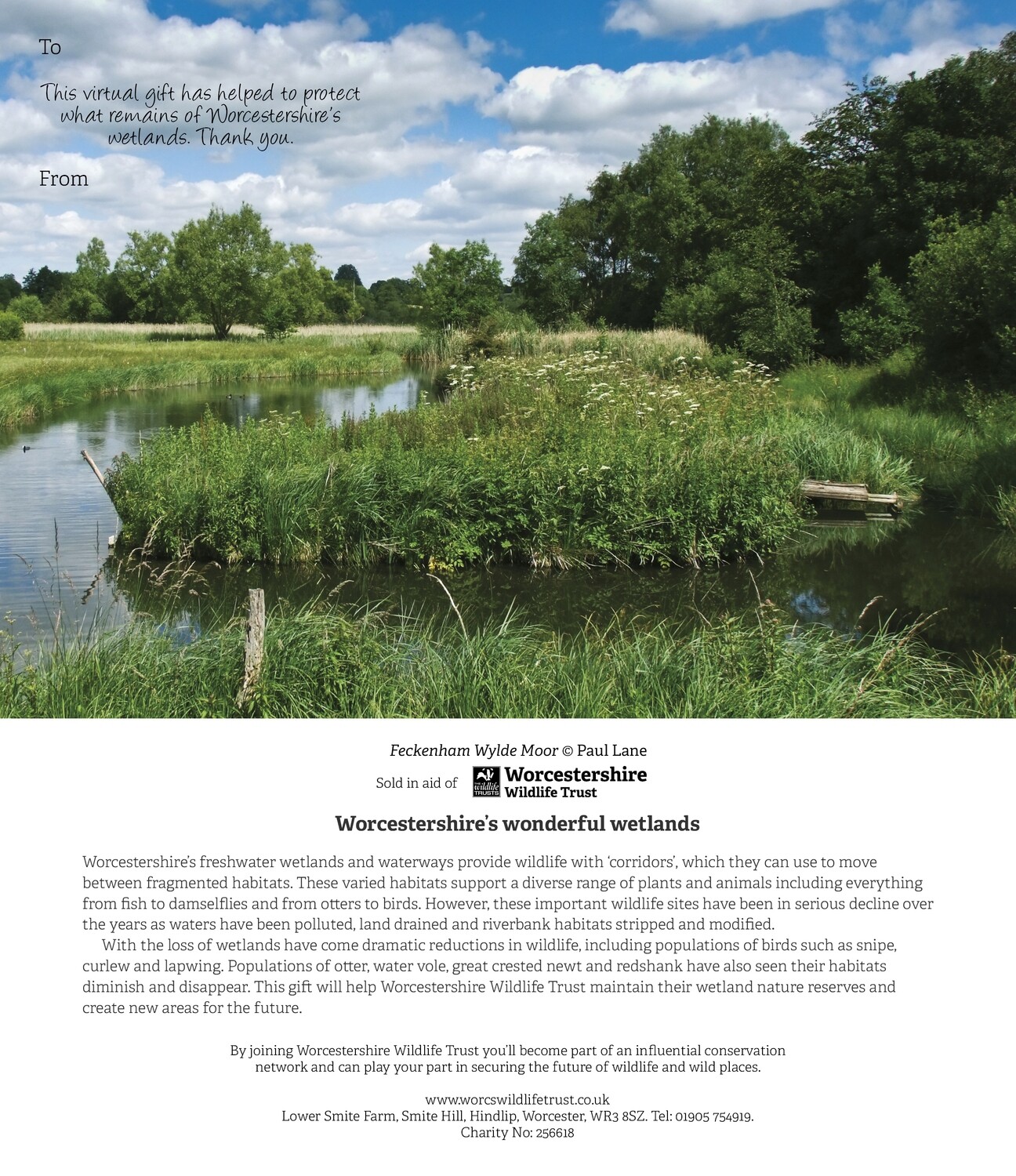

Photo by Paul Lane